Accumulated depreciation formula balance sheet

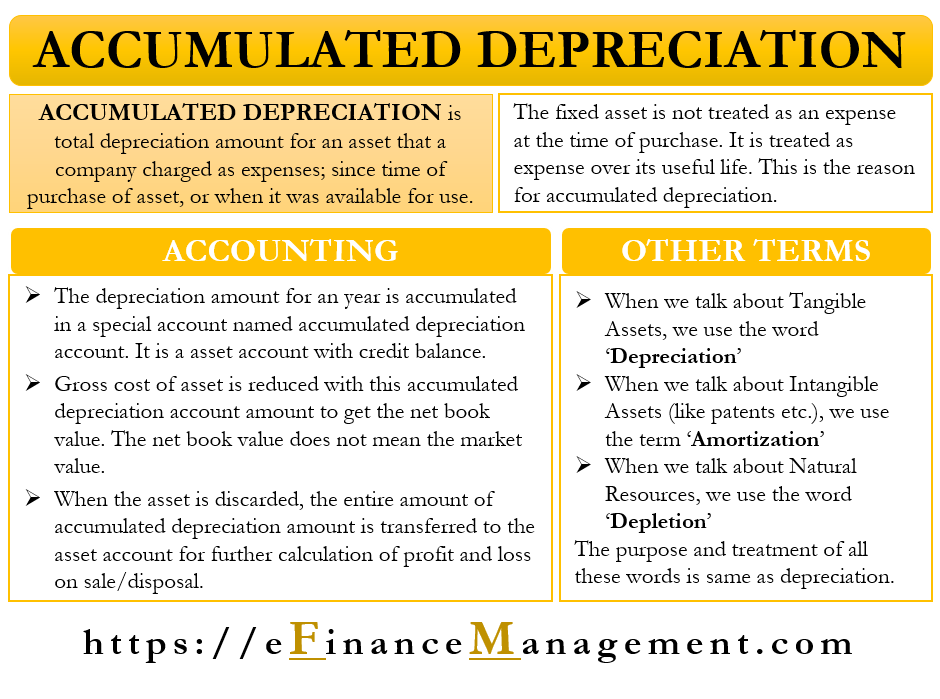

Accumulated depreciation is the total amount of depreciation assigned to a fixed asset over its useful life. Depreciation expense is reported on the income statement as any other normal business expense while accumulated depreciation is a running total of depreciation.

Straight Line Depreciation Accountingcoach

Total yearly depreciation Depreciation factor x 1.

. The final method for calculating accumulated depreciation is the SYD or sum of the years digits. Accumulated depreciation formula Accumulated Depreciation Balance Beginning Period AD Depreciation Over Period End Period AD Read more about Bank reconciliation. Accumulated Depreciation Balance Sheet Sample will sometimes glitch and take you a long time to try different solutions.

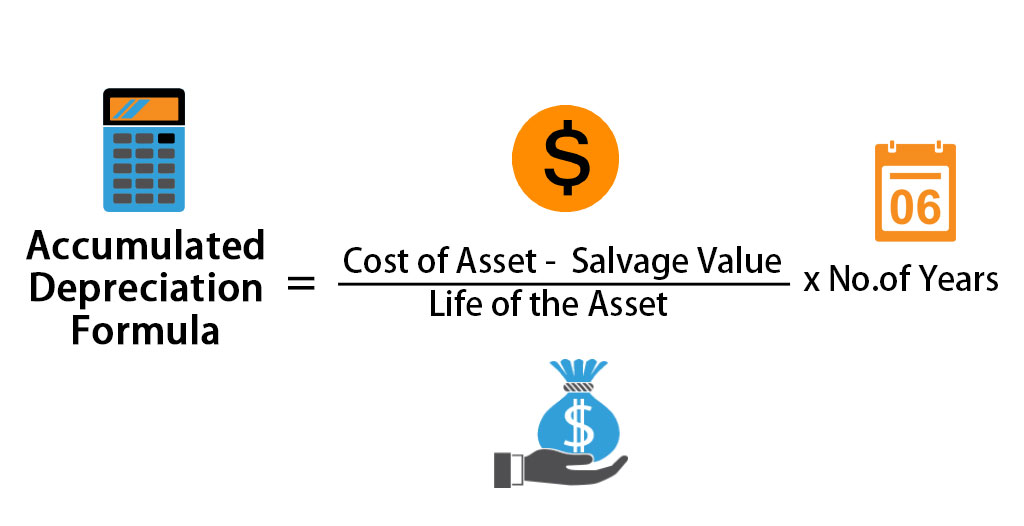

Accumulated Depreciation Cost of the Asset - Salvage Value Life of the Asset Number of Years This was our calculation. Annual Accumulated Depreciation Depreciable Base Inverse Year Number Sum of Year Digits Company ABC purchased a piece of equipment that has a useful life of 5. Accumulated depreciation of an asset is an important financial metric for the.

Ad Free Trial - Track Sales Expenses Manage Inventory Prepare Taxes More. Depreciation Expense Remaining Useful Life Sum of The. Accumulated Depreciation Cost of Fixed Asset Salvage Value Useful Life Assumption Number of Years.

100000 20000 8 10000 in depreciation expense per year Download the. The formula for accumulated depreciation under the straight-line method may look as follows. 50000 x 20 10000 The first years depreciation expense would be.

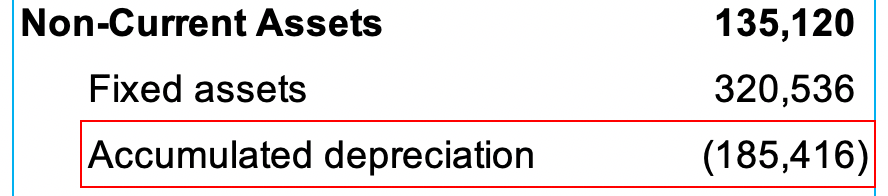

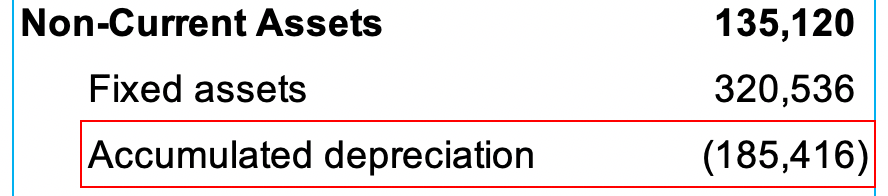

Accumulated Amortization Amortized. A balance sheet lists all the companys assets and categorizes each of them by the type of asset. LoginAsk is here to help you access Accumulated Depreciation On.

For Less Than 2 A Day Save An Average Of 30 Hours Per Month Using QuickBooks Online. Accumulated depreciation is with the assets on a balance sheet. The formula for calculating straight-line depreciation is as follows.

The basic formula for straight-line depreciation is. LoginAsk is here to help you access Accumulated Depreciation. Accumulated Depreciation 100000 -.

Using the double-declining method formula the companys bookkeeper calculates the accumulated depreciation to add it to the companys balance sheet. On the balance sheet this is done by increasing an account called accumulated depreciation which acts as an offset to the value of the asset. Using the formula for accumulated depreciation the calculation for year 2 with the values filled in is.

Asset cost Expected salvage value Useful life x Years in use For the. Accumulated Depreciation On A Balance Sheet will sometimes glitch and take you a long time to try different solutions. You can use the following basic declining balance formula to calculate accumulated depreciation for years.

On the balance sheet the. For example you are using. This formula looks like this.

The calculation for the declining balance method is current book value x depreciation rate. On December 31 2017 what is the balance of the accumulated depreciation account. Step 3 Subtract the accumulated depreciation on the prior accounting periods balance sheet from the accumulated depreciation on the most recent periods balance sheet to calculate the.

45000 10 years 4500 annual depreciation This will reduce your reported net income by 4500 each year. Accumulated Amortization Formula The accumulated amortization formula is a total value that may be stated numerically as follows.

Reducing Balance Depreciation Calculator Double Entry Bookkeeping

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-02-b230b73e49c3406ba7b944172f09a624.jpg)

Why Is Accumulated Depreciation A Credit Balance

Accumulated Depreciation Accountingtools India Dictionary

Depreciation Of Fixed Assets Double Entry Bookkeeping

Accumulated Depreciation Definition And Why It Is Important Fincent

Accumulated Depreciation Definition Formula Calculation

Depreciation Expense Depreciation Expense Accountingcoach

Depreciation Formula Examples With Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Calculation Journal Entry Accountinguide

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

Accumulated Depreciation Overview How It Works Example

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Meaning Accounting And More

Accumulated Depreciation Explained Bench Accounting